Overview

As 2024 draws to a close, the Oceania market is under pressure from seasonal demand surges, capacity constraints, and evolving global challenges. The ongoing peak season, coupled with preparations for Chinese New Year in January 2025, is further straining supply chains. This update provides Australian and New Zealand businesses with the latest insights and strategies to maintain efficiency and resilience during this critical period.

Ocean Freight Market Insights

Rates and Capacity

Asia–Oceania trade lanes are under substantial pressure:

- Freight Rates: Rates remain significantly higher compared to the same period last year, with the Shanghai Containerized Freight Index (SCFI) showing a year-on-year increase of 128% to Oceania.

- Capacity Constraints: The idle fleet of containerships has reached a historic low of less than 1% in 2024, indicating high utilisation and limited available capacity.

Port Congestion Updates

Port congestion continues to impact operations across the region:

- Australia: Brisbane is experiencing delays of up to 4 days, followed by Sydney (2 days), and Melbourne, Fremantle, and Adelaide (1 day each).

- New Zealand: Wellington faces the longest delays at up to 6 days, followed by Auckland (2 days) and Tauranga (1 day).

Tauranga Port Rail Closure

KiwiRail’s Auckland/Holiday Block of Line plan will affect rail freight services between Auckland Metroport and the Port of Tauranga from 27 December 2024 to 27 January 2025. These closures are necessary to support the Auckland City Rail Link (CRL) work programme.

Key Impacts and Mitigation Measures:

- Affected Route: Hamilton–Auckland rail link

- Dry Containers: Road-bridged between Hamilton and Auckland Metroport

- Reefer Containers: Road-bridged directly between Tauranga and Auckland Metroport

We are working closely to manage cargo flows and maintain seamless service coverage during this period. If you need assistance with alternative transport solutions or have any questions, please contact your Seabridge account representative.

Biosecurity Challenges

The Brown Marmorated Stink Bug (BMSB) season continues to delay shipments at Australian ports by 48–72 hours. Businesses must prioritise compliance with biosecurity regulations to avoid further disruptions.

Air Freight Market Insights

Rates and Utilisation

Global air freight capacity has grown by 5% year-on-year, driven by the return of widebody passenger aircraft. However, high utilisation rates keep space tight:

- Delays: Australian airports, including Sydney and Melbourne, report delays of 5–6 hours due to elevated seasonal volumes.

- Rates: Rates remain high, fuelled by demand for e-commerce, perishables, and high-value goods leading up to Chinese New Year.

Air freight remains critical for time-sensitive shipments. Advance bookings are essential to secure capacity and manage costs during this busy season.

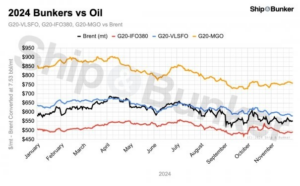

Bunker Prices

Outlook for 2025

Bunker fuel prices, a key cost driver in ocean freight, are projected to stabilise in 2025, with regional variations influenced by regulatory changes:

- VLSFO Prices: The average Very Low Sulphur Fuel Oil (VLSFO) price is expected to decrease to USD 585 per metric ton in 2025, down from USD 630 per metric ton in 2024.

- EU ETS Impact: In Europe, the introduction of the EU Emissions Trading System (ETS) will raise operational costs, pushing effective bunker prices to approximately USD 795 per metric ton.

Schedule Reliability Insights

Global vessel schedule reliability remains a concern:

- Improvement: October 2024 schedule reliability improved slightly to 53.3% (a 0.5 percentage point increase month-on-month), but remains 8.7 percentage points lower year-on-year.

- Delays: Average delays for late vessel arrivals are 5.72 days, highlighting continued disruptions across major trade lanes.

Global Risks

Potential U.S. Port Strikes

The International Longshoremen’s Association (ILA) is poised to initiate a strike at U.S. East Coast and Gulf Coast ports starting 15 January 2025, following unsuccessful contract negotiations concerning wages and terminal automation.

Implications for Oceania Trade:

- Supply Chain Disruptions: Potential delays for goods entering the U.S. and reduced availability of empty containers for other routes.

- Political Dynamics: President-elect Trump’s support for the ILA’s stance against automation may influence the resolution timeline.

Recommendations:

- Contingency Planning: Develop alternative strategies for U.S.-bound sea freight to mitigate potential disruptions.

- Stay Informed: Monitor developments closely, as political interventions could affect the strike’s duration and impact.

EU Regulatory Changes

From 1 January 2025, the EU Emissions Trading System (ETS) will impose stricter emissions allowances, increasing costs for Europe-bound shipments. Businesses trading with Europe should factor these added expenses into their planning.

Contact Us

Seabridge is committed to supporting your logistics needs with tailored solutions, real-time updates, and expert guidance. For more information or assistance, please contact your Seabridge account representative.

Australia

Australia New Zealand

New Zealand