The Oceania logistics market has begun 2025 navigating complex challenges shaped by peak seasonal demand, capacity constraints, and global trade dynamics. The Lunar New Year, potential U.S. port disruptions, and new regulatory frameworks are among the key factors influencing supply chains for businesses in Australia and New Zealand. This update provides actionable insights and strategies to help businesses adapt to this evolving landscape.

Ocean Freight Insights

Rates and Capacity

- Asia-Oceania Trade Lanes: Freight rates remain elevated due to tight capacity and high demand.

- China-to-Australia Rates: Currently range between USD 5,500–7,000 per 40ft container, driven by pre-Lunar New Year pressures.

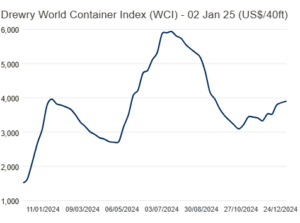

- Global Trends: Drewry’s World Container Index rose 3% to USD 3,905 per 40ft container in early January, 175% higher than pre-pandemic levels.

- Outlook: Relief is anticipated in late 2025 as new vessels are introduced to global fleets.

Drewry’s World Container Index [Source: Drewry]

Port Congestion

- Australia: Brisbane faces delays averaging four days, followed by Sydney (three days). Melbourne and Adelaide report moderate delays of two days each.

- New Zealand: Wellington remains the most affected with delays of six days, while Auckland and Tauranga report delays of three and two days, respectively.

Global Schedule Reliability

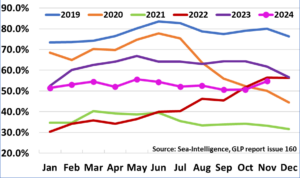

- Improvements: Global schedule reliability reached 54.8% in November 2024, marking the highest level of the year, though still below pre-pandemic norms.

- Delays: Average delays for late vessel arrivals improved to 5.41 days, decreasing by 0.43 days month-over-month.

Global Schedule Reliability [Source: Sea-Intelligence]

Tauranga Port Rail Closure

KiwiRail’s Auckland/Holiday Block of Line plan (27 December 2024–27 January 2025) has disrupted rail freight services between Auckland Metroport and the Port of Tauranga.

Mitigation Measures:

- Dry Containers: Road-bridged between Hamilton and Auckland Metroport.

- Reefer Containers: Road-bridged directly between Tauranga and Auckland Metroport.

Seabridge is working closely with stakeholders to minimise disruptions and maintain cargo flows. Contact your Seabridge representative for alternative solutions.

Bunker Price Outlook

- Global Trends: The average price for Very Low Sulfur Fuel Oil (VLSFO) is projected to decline to USD 585 per metric ton in 2025, down from USD 630 in 2024.

- Europe Impact: The EU Emissions Trading System (ETS) will increase costs for Europe-bound shipments, with intra-EU fuel expenses rising by 27.5%.

Air Freight Insights

The air freight market remains a vital solution for time-sensitive shipments, driven by strong e-commerce growth and geopolitical uncertainties.

- Global Cargo Volumes: The International Air Transport Association (IATA) forecasts volumes to reach 72.5 million tonnes in 2025, a 5.8% increase from 2024.

- Revenue: Cargo revenues are expected to hit USD 157 billion, contributing to 15.6% of total airline revenues.

- Rates and Capacity: Average freight rates are projected to decrease by 0.7% in 2025 but remain above pre-pandemic levels. Capacity has grown by 5% year-over-year, supported by the return of widebody passenger aircraft.

- Asia-Pacific: High utilisation rates persist, particularly for e-commerce, perishables, and high-value goods, tightening available space.

Key Recommendation: Advance bookings and accurate forecasting are essential to secure space and manage costs during peak periods.

Global Markets Overview

- Inflation: Global headline inflation is projected to decline to 3.5% by the end of 2025, slightly below pre-pandemic averages.

- U.S. Economy: Forecasted GDP growth of 2.8% in 2024, driven by resilient consumer spending and robust investment.

- Eurozone: Modest GDP growth of 0.8% in 2024, with gains in exports and retail sales offset by manufacturing challenges.

- China: Economic growth is forecasted at 4.8%, supported by strong net exports despite domestic headwinds like weak real estate and consumer confidence.

Potential Risks and Delays

U.S. Port Strikes

Update: The International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX) have reached a tentative six-year Master Contract agreement, averting a potential work stoppage on 15 January 2025. This agreement includes provisions for job protection and technological enhancements at East and Gulf Coast ports. [Source: ILA-USMX Joint Statement]

This development eliminates the immediate risk of U.S. port disruptions, providing stability to supply chains reliant on these critical trade lanes. Seabridge will continue monitoring developments to ensure seamless service for our customers.

U.S.-China Trade Tensions

The incoming Trump administration has signalled potential tariff reinstatements or expansions on Chinese imports. Businesses are advised to anticipate possible disruptions in services, freight rates, and capacity.

Sustainability in Logistics

Seabridge is committed to helping customers reduce their carbon footprints through innovative and sustainable logistics solutions.

- Eco-Friendly Options: Optimised shipping routes and consolidation strategies help lower emissions.

- Visibility Tools: Advanced CO2 calculators offer insights into shipment-level environmental impacts, enabling informed decision-making.

Discover more about our commitment to sustainability here: Powering a Greener Future.

Looking Ahead

The logistics landscape in 2025 will require businesses to balance resilience with adaptability. To remain competitive and mitigate risks, businesses should:

- Plan Ahead: Secure ocean freight bookings 4–6 weeks in advance to lock in capacity and manage rate fluctuations. Early planning for air freight is crucial for time-sensitive shipments.

- Adopt Technology: Leverage digital platforms like Seabridge’s HIVE for real-time shipment tracking, scheduling optimisation, and data-driven decision-making.

- Embrace Sustainability: Align supply chain strategies with sustainability goals to reduce environmental impacts and meet customer demands for greener logistics.

- Prepare for Disruptions: Monitor geopolitical developments, regulatory changes, and market trends. Develop contingency plans to address potential disruptions like U.S. port strikes or trade policy changes.

Seabridge remains committed to supporting businesses in Australia and New Zealand with tailored logistics solutions and timely market intelligence. For further information or specialised advice, contact your local Seabridge representative.

Australia

Australia New Zealand

New Zealand